Underrated Ideas Of Info About How To Improve The Current Ratio

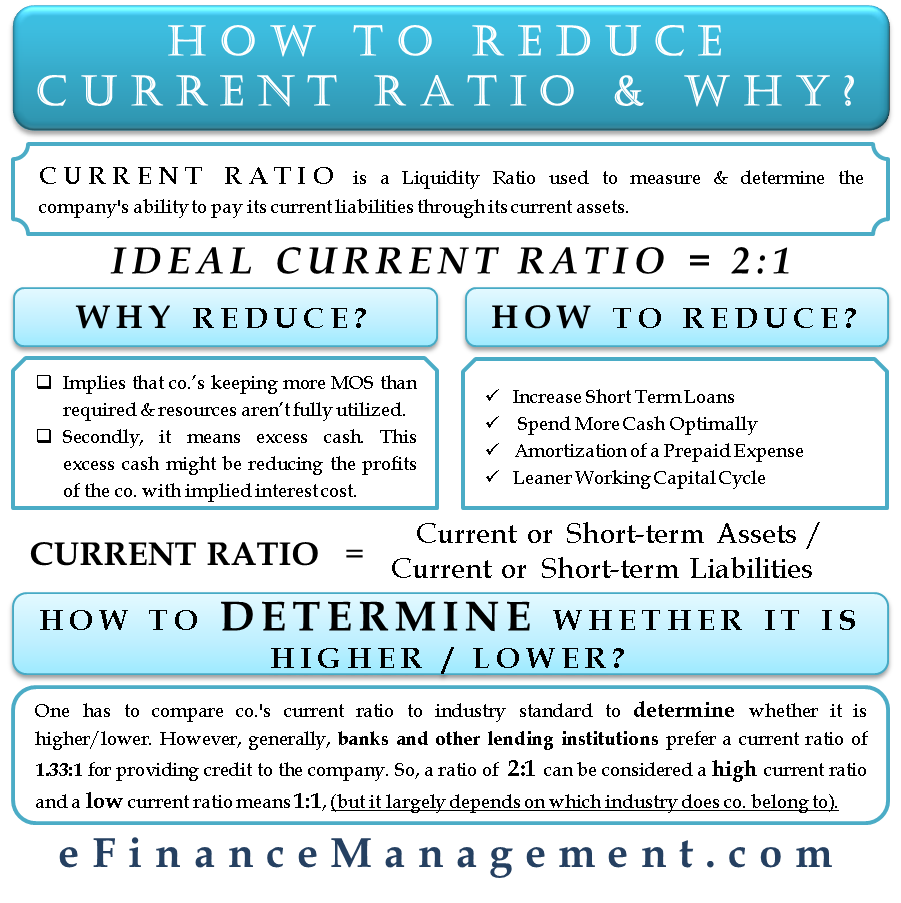

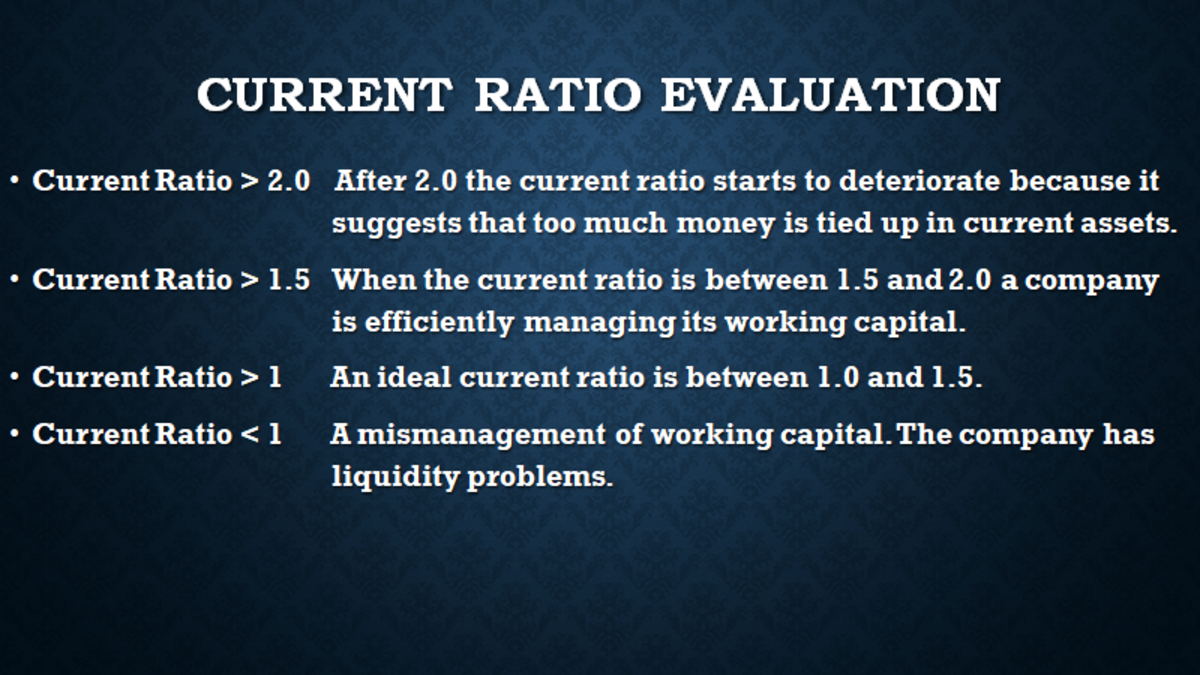

Improving your company’s current ratio the ideal current ratio varies by industry, but you should aim to be at or above the average in your sector.

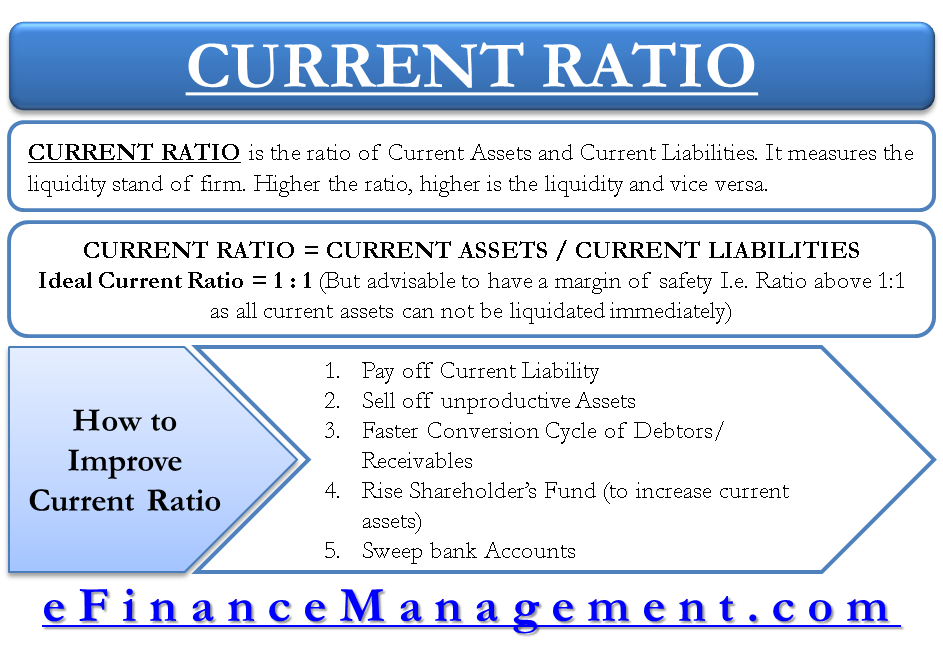

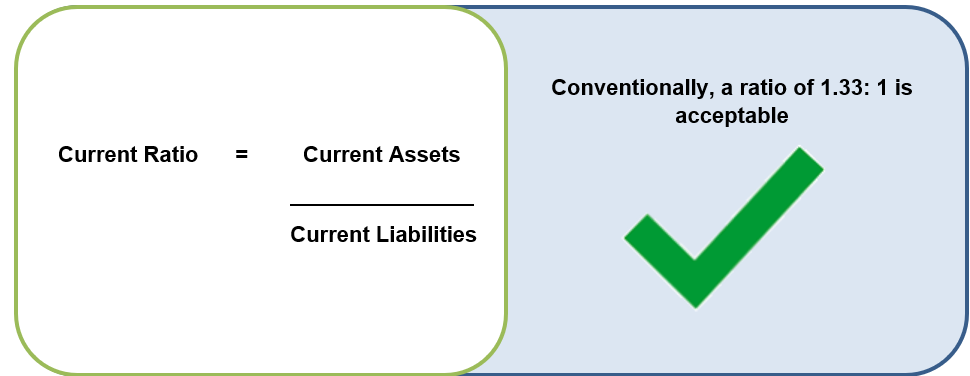

How to improve the current ratio. It is calculated by dividing the company’s current assets by the company’s current liabilities. To have enough cash to pay your operating expenses, family living, taxes and all debt payments on time. What causes increase in current ratio?

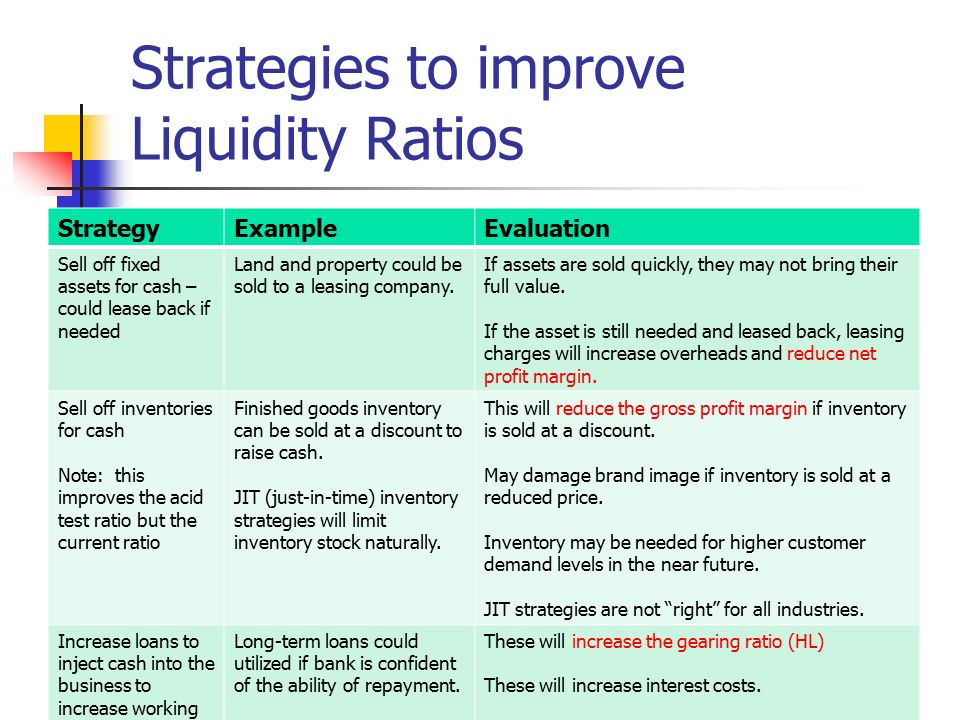

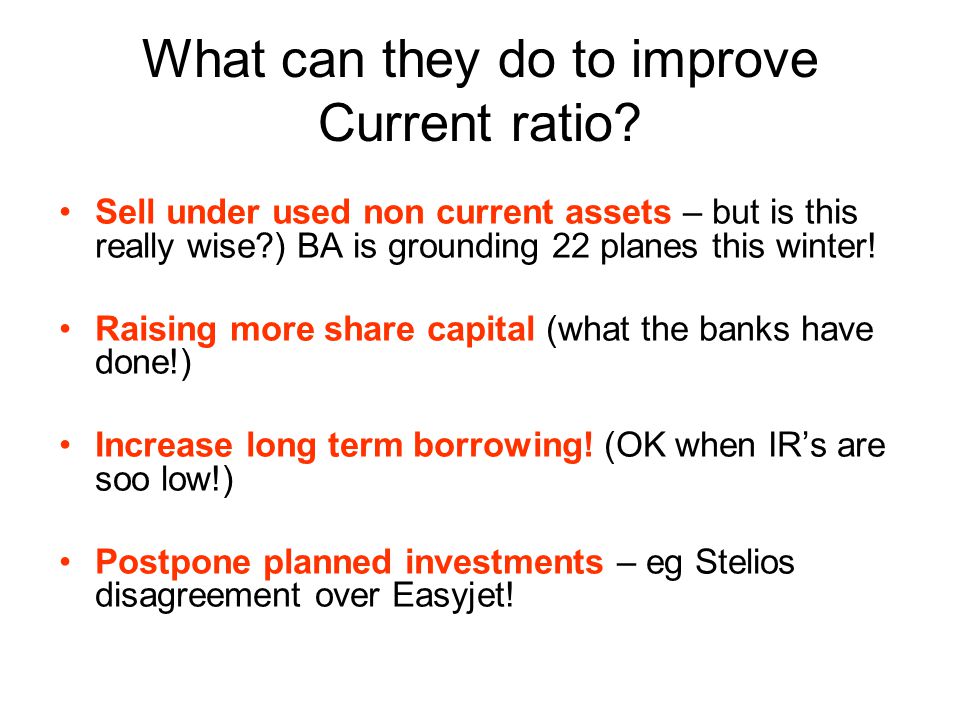

Reclassifying current debts into long term debt will basically reduces. A firm may improve its liquidity ratios by raising the value of its current assets, reducing the value of current liabilities, or negotiating delayed or lower payments to creditors. The current ratio is an assessment of current assets to current liabilities.

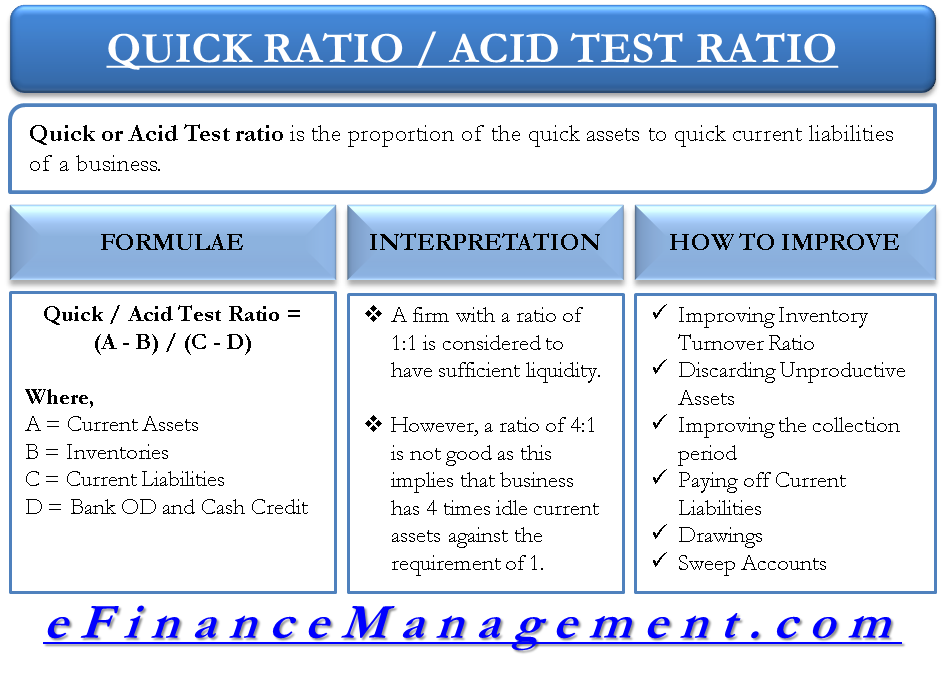

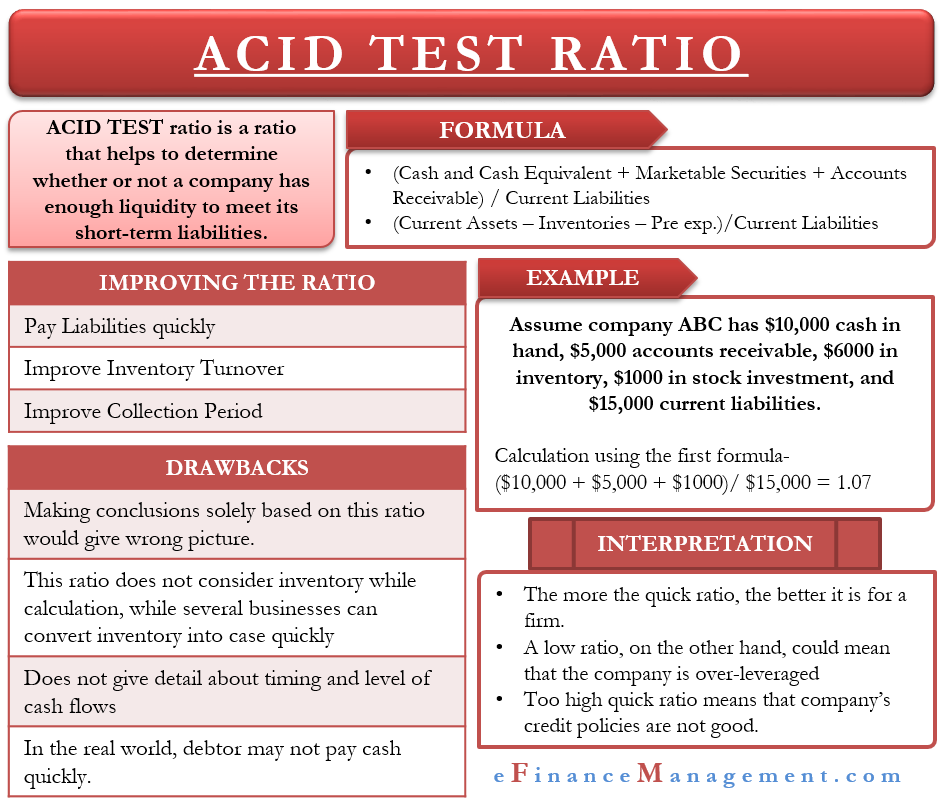

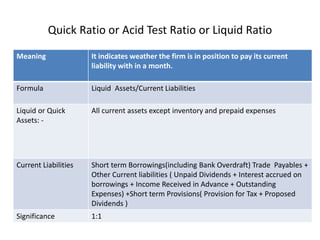

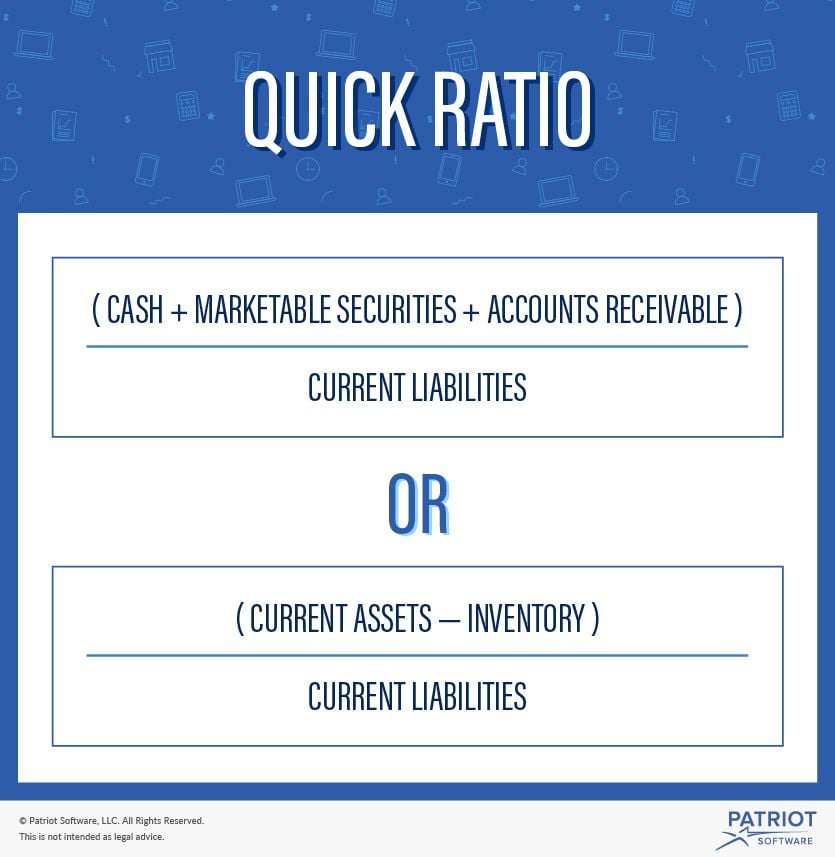

Two of the most common liquidity ratios are the current ratio and the quick ratio. One of the quickest ways to improve the quick ratio would be to pay off the current bills and at the same time increase sales so that the cash on hand or ar increases. You can improve your quick ratio by doing the following:

Current assets consist of all of a company’s assets that are expected to be used, sold during the current fiscal year or operating cycle. Pay off as much debt as possible. Its current liabilities, meanwhile, consist of $100,000 in accounts payable.

The quick ratio excludes inventory and some other current. That is, their escalations increase the total current assets. This tool refines the current ratio, measuring the amount of the most liquid assets a company has to cover liabilities.

Improving current ratio the operation can improve the current ratio and liquidity by:. In this scenario, the company would have a current ratio of 1.5, calculated by dividing its current. Improving current ratio delaying any capital purchases that would require any cash payments.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-02-8806530bcda84b2b9cb3218413e8a417.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Ratio_Jul_2020-03-54eeb2ed66a546ad8c2f1e5e86366170.jpg)