Fine Beautiful Tips About How To Buy Title Insurance

You can buy a residential title insurance policy at any time while you own a property.

How to buy title insurance. You can start by looking online. When completing an alabama car title application, car owners must provide the designated agent with information such as the following: You need to get a policy from the right company, with the right backing, so you can trust what they tell you and have the peace of mind that goes along with good insurance.

How do you know where to buy owner’s title insurance and lender’s title insurance? You will only make one premium. Talk to your lawyer or insurance representative to understand your coverage options.

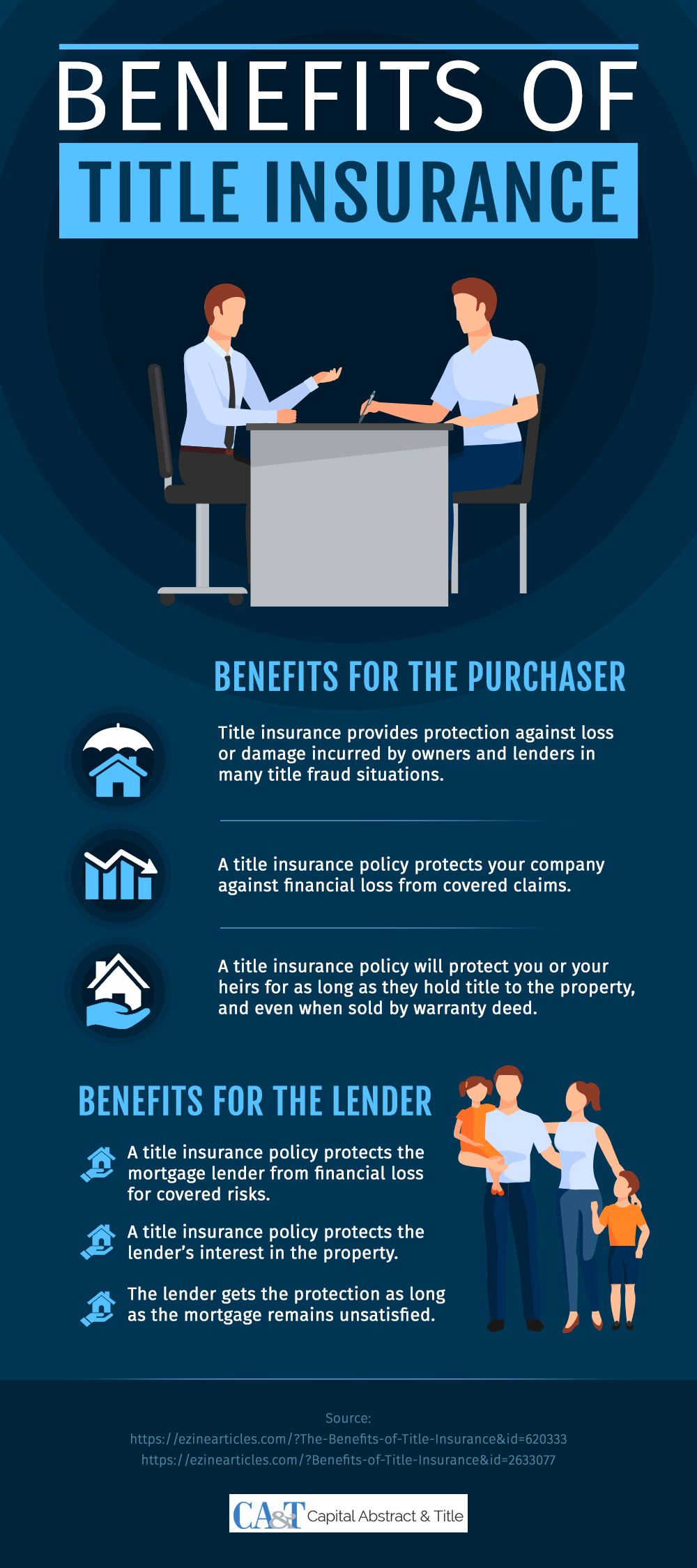

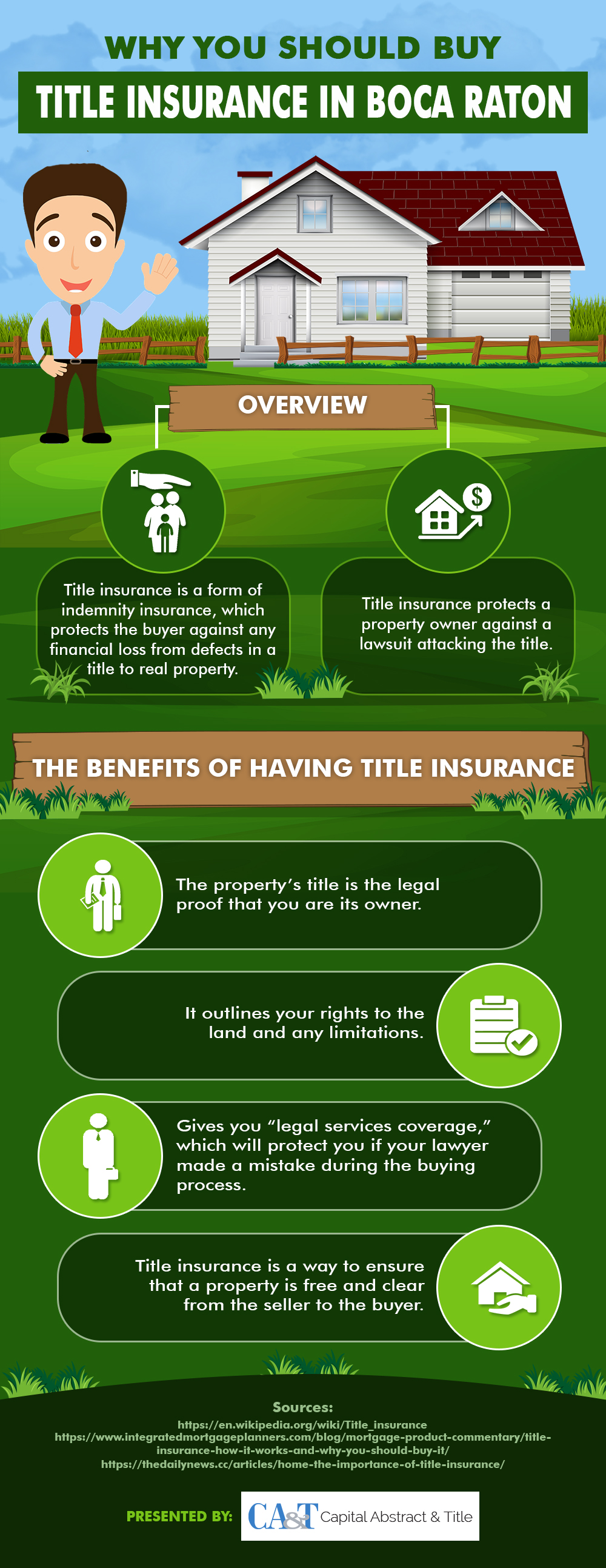

Title insurance is a form of indemnity insurance predominantly found in the united states which insures against financial loss from defects in title to real. You may want to buy an. Most lenders require you to buy a lender’s title insurance policy, which protects the amount they lend.

Simply search for title companies located within your area. You should get a title insurance policy anytime you buy real estate. The bottom line is that an owner’s policy provides you, the homeowner, with the protections that title insurance offers while the lender’s policy provides those benefits only to.

Check your status / licensee search. How to buy title insurance during the home purchasing process. Title insurance is generally purchased when you buy your home or when you refinance it, although it can be purchased any time after you buy your home.

Try bringing the seller to your local dmv to resolve a signed title before. No ifs, ands or buts about it. If you buy a car with the vehicle title already signed, you won’t be able to register it in your name.

/titleinsurance2-3a38d7b00c3f49a0a09dfbb2c9d7e991.png)

/titleinsurance2-3a38d7b00c3f49a0a09dfbb2c9d7e991.png)